Close

StrategyQuant is the most powerful platform to generate, develop and research Algo strategies with a click of a button. It is the ultimate tool for both experienced and novice traders. With its simple user interface, it allows you to quickly generate, back-test, and optimize your strategies without any programming skills.

Utilize the tools used by hedge funds and expert quants. Build a QUANTIFIED portfolio of your own trading techniques.

StrategyQuant is a machine learning platform that uses genetic programming to automatically generate new trading systems for any market and timeframe. It combines and verifies millions of different entry and exit conditions, order types, and price levels to find the best-performing strategies according to your selection criteria.

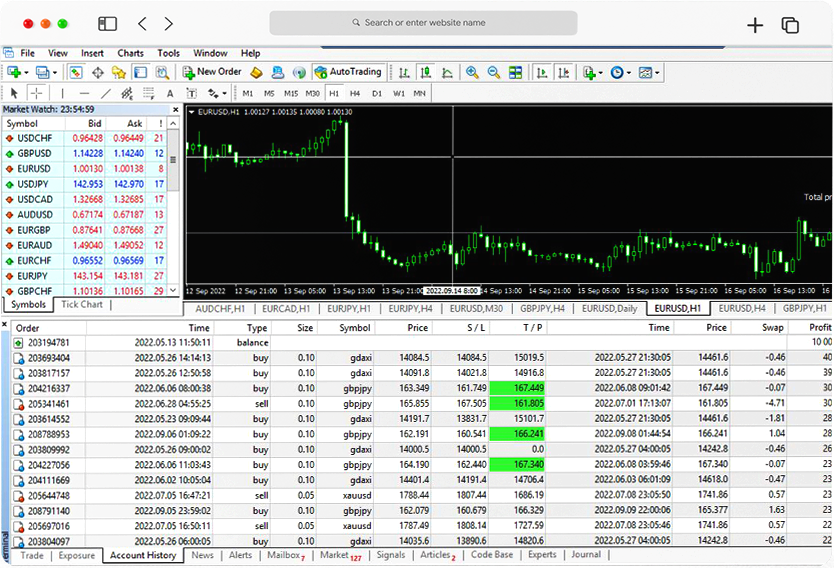

Using Algo Trading Systems is a revolutionary new trade method that takes all the stress and guesswork out of the process. Using sophisticated algorithms, they continuously monitor the market and make trading decisions on your behalf, so you can relax and let them take care of things.

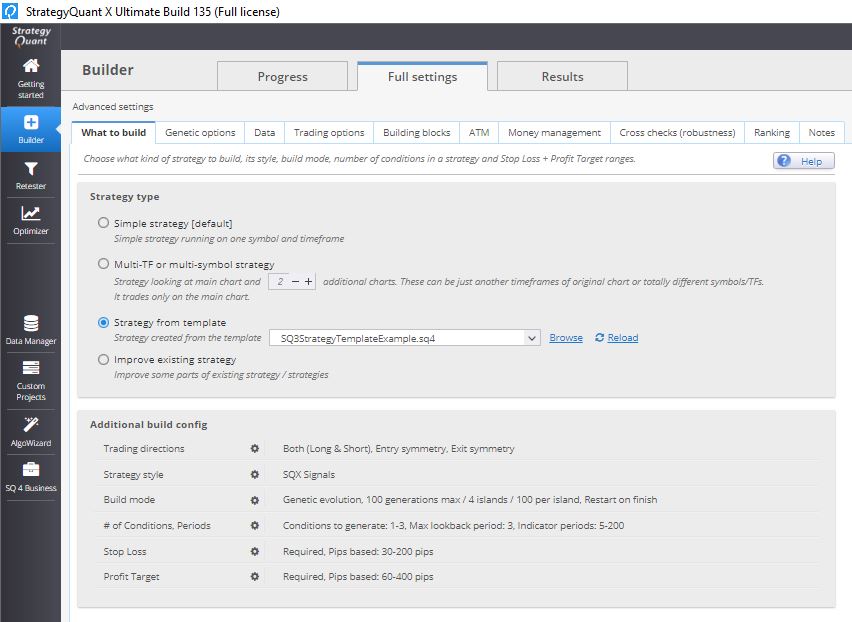

Using multiple input charts with different symbols or timeframes, StrategyQuant can create strategies adaptable to any market condition.

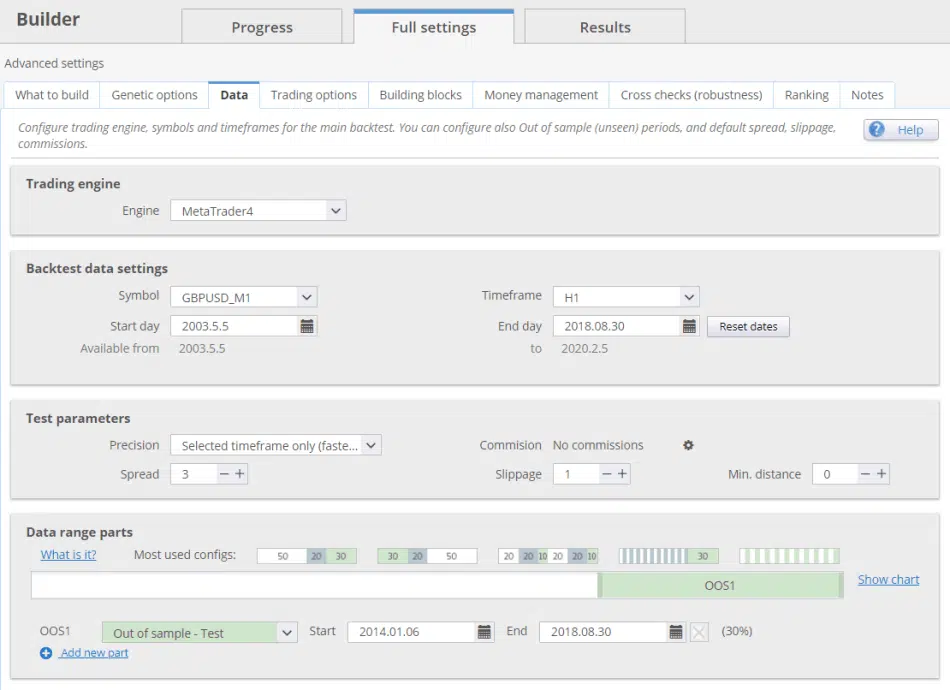

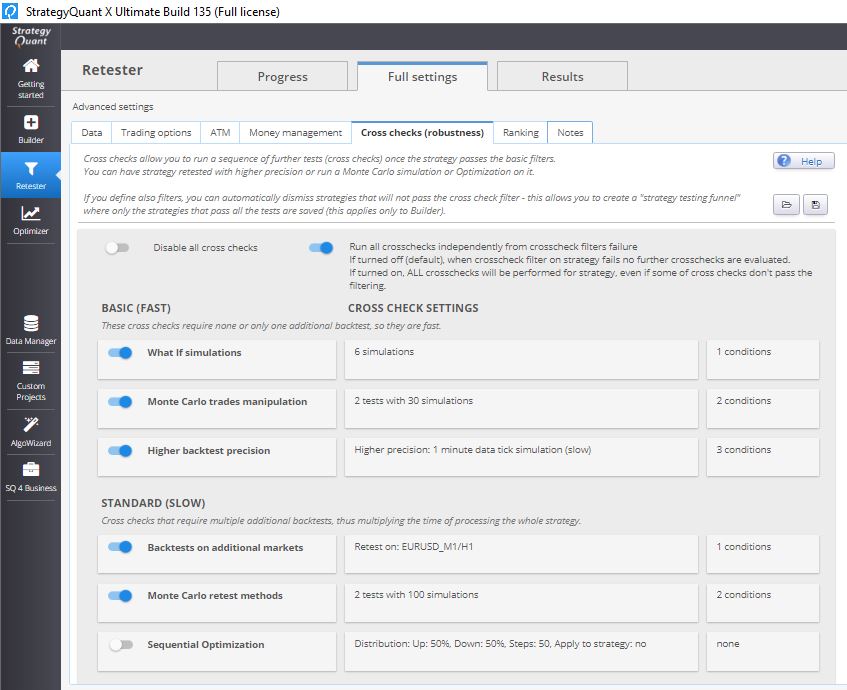

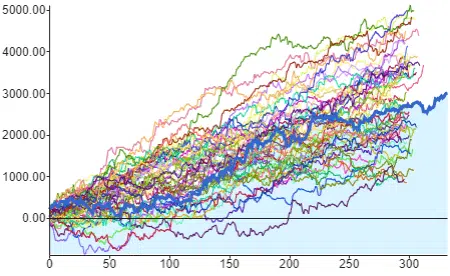

StrategyQuant uses multiple advanced techniques to ensure your strategies are robust and have a real edge on the market. Advanced techniques like Monte Carlo simulations, Walk-Forward Optimizations / Matrix, System Parameter Permutations, Optimization Profiles, and What-If simulations can be applied automatically as a part of the building process.

Download up-to-date, high-quality data for forex and stocks directly from Dukascopy & Yahoo Finance, all for free.

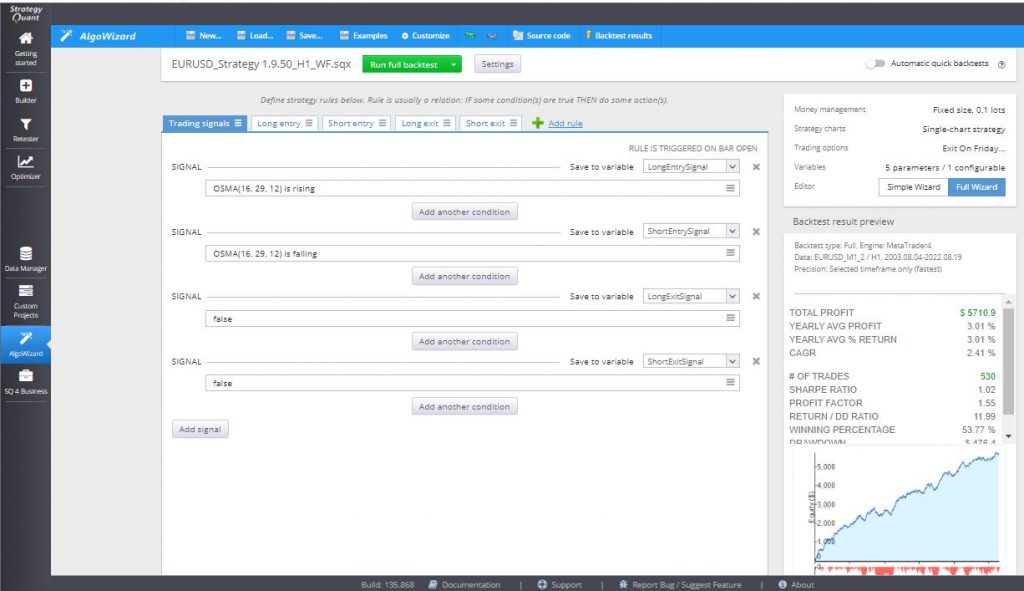

StrategyQuant allows you to create and backtest trading strategies without any programming required. Simply select indicators and create a rule-based system, and StrategyQuant will export the strategy in a full source code for the given trading platform, ready to be traded on a demo or live account.

StrategyQuant is a machine learning platform that uses genetic programming to automatically generate new trading systems for any market and timeframe. It combines and verifies millions of different entry and exit conditions, order types, and price levels to find the best-performing strategies according to your selection criteria.

Using Algo Trading Systems is a revolutionary new trade method that takes all the stress and guesswork out of the process. Using sophisticated algorithms, they continuously monitor the market and make trading decisions on your behalf, so you can relax and let them take care of things.

Using multiple input charts with different symbols or timeframes, StrategyQuant can create strategies adaptable to any market condition.

StrategyQuant uses multiple advanced techniques to ensure your strategies are robust and have a real edge on the market. Advanced techniques like Monte Carlo simulations, Walk-Forward Optimizations / Matrix, System Parameter Permutations, Optimization Profiles, and What-If simulations can be applied automatically as a part of the building process.

Download up-to-date, high-quality data for forex and stocks directly from Dukascopy & Yahoo Finance, all for free.

StrategyQuant allows you to create and backtest trading strategies without any programming required. Simply select indicators and create a rule-based system, and StrategyQuant will export the strategy in a full source code for the given trading platform, ready to be traded on a demo or live account.

Use our Promo Code to get 20% off:

QuantBot

The discount will be less during SQ special campaigns

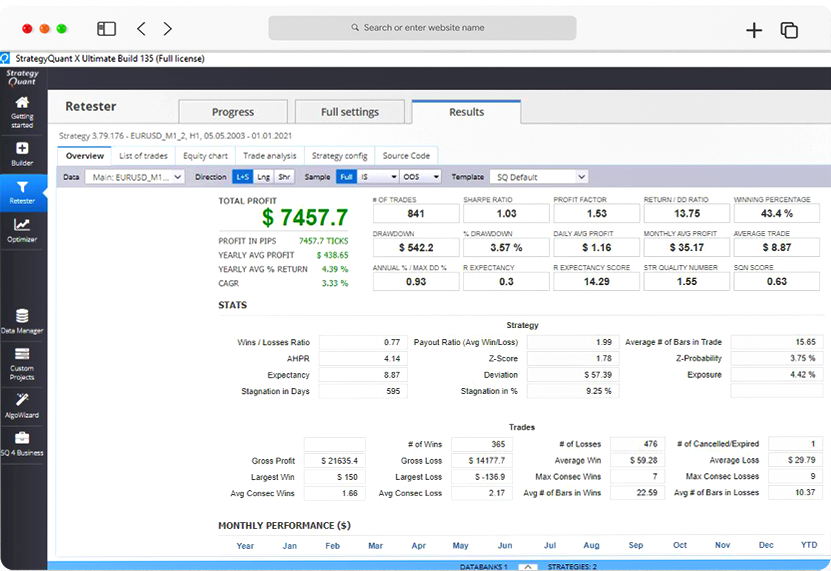

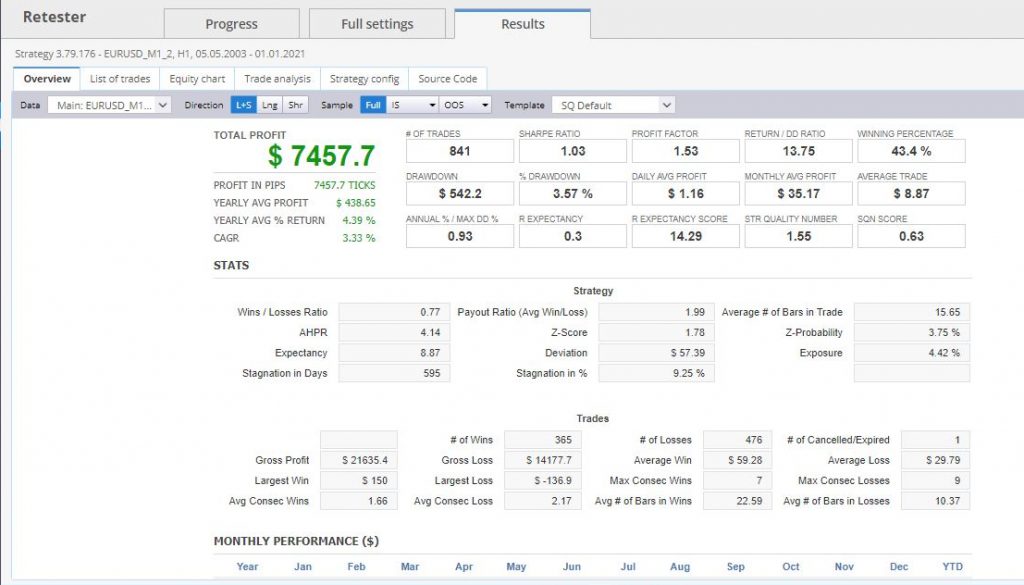

StrategyQuant is a powerful platform for creating, retesting, and optimizing algorithmic trading strategies in any market and timeframe.

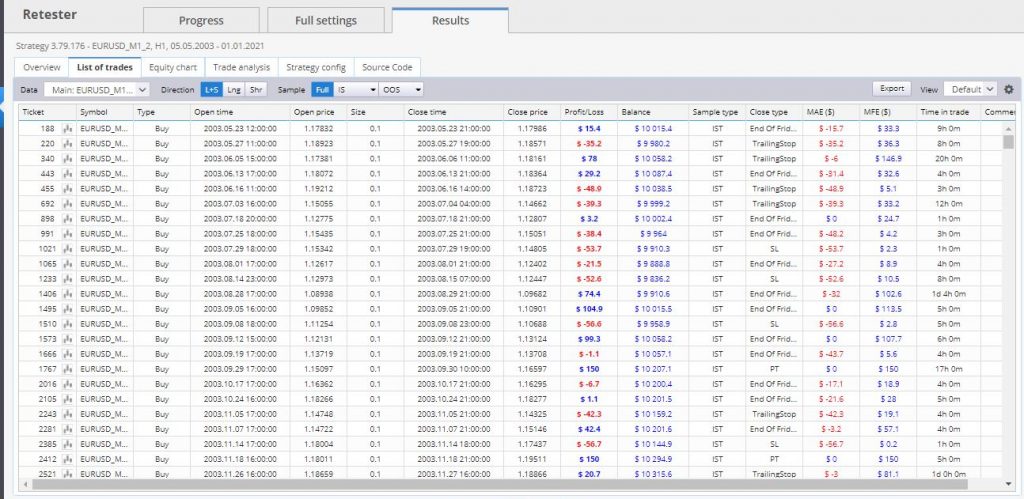

StrategyQuant has its own extremely fast backtesting engine that can perform hundreds of backtests per second based on your data and test precision.

All standard technical indicators are supported by StrategyQuant (like CCI, RSI, MACD and so on). It also supports several candle formations, 4 types of trade entry, and six types of exits, with the list extending all the time. Furthermore, you can easily customize StrategyQuant with your own preferred indicator or building block, either visually in the AlgoWizard editor (Custom blocks) or by writing your own snippet.

Easy to install, know how videos available.

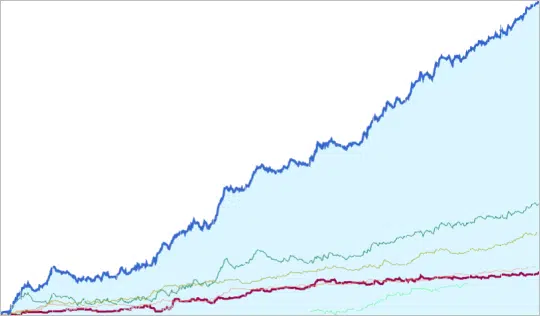

Portfolio trading can be simulated by combining different strategies into a portfolio – utilizing multiple portfolio models.

With AlgoWizard, you can quickly and easily create or edit trading strategies without any programming knowledge.

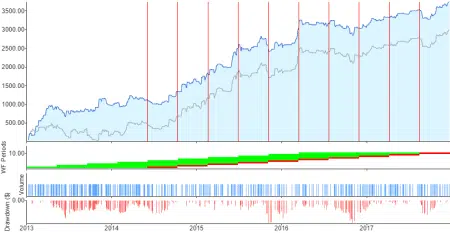

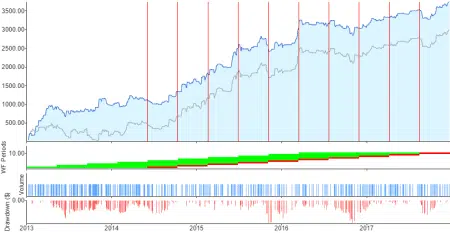

Walk Forward Optimization is a unique optimization process that addresses the issue of curve fitting in strategy development.

Display candle chart including all used indicators and trades as they were filled, to spot trading patterns visually.

Use an unlimited number of OOS and carry out advanced filtering based on each OOS period’s results independently.

The daily equity or maximum open profit or loss is automatically calculated and shown in the equity chart.

Tools are designed specifically to help avoid overfitting when training models for data mining and machine learning.

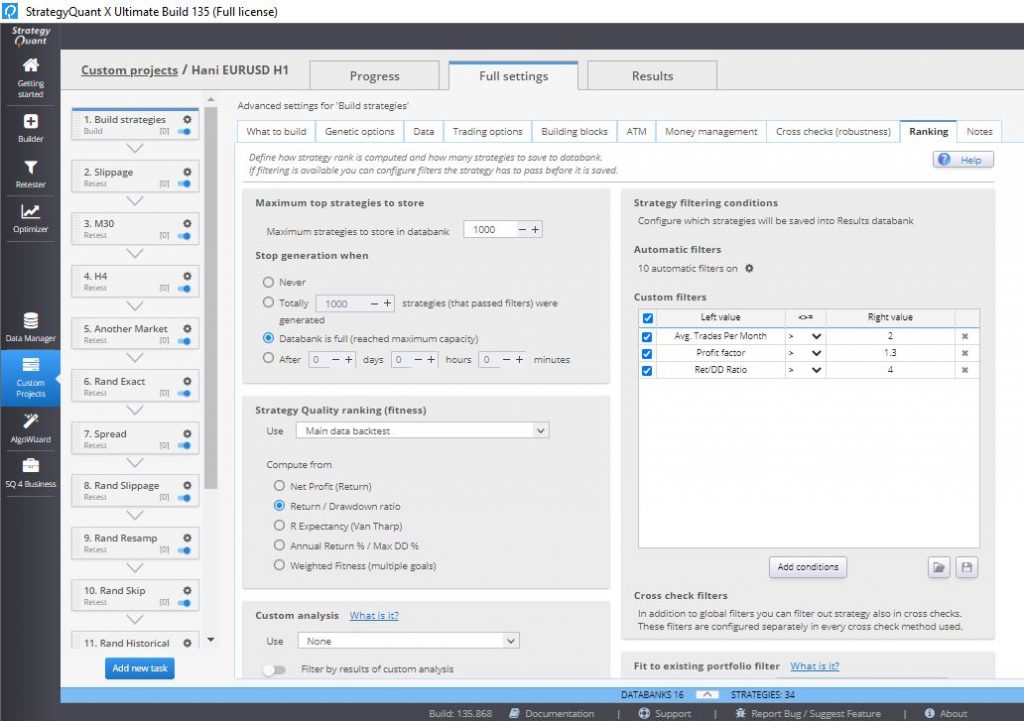

Built-in tools and checks are a crucial component of StrategyQuant’s features since they guarantee that the developed strategies have a genuine competitive advantage and will continue to be effective in the future without being overfitted to the data. The process of developing strategies includes robustness testing (cross checks), which may be turned on or off with the press of a button.

You can simulate the behavior of your approach with various random variations using two independent Monte Carlo tests with more than nine simulation kinds. Monte Carlo tests are easily integrated into building workflows, and strategies that fail the tests are instantly rejected.

You can use the built-in optimizer to simplify or walk-forward-optimize your techniques. With Walk-Forward Matrix, you can verify if there are any clusters of “optimal” and stable parameters for your strategy (cluster analysis).

Packed with features that you won’t find anywhere else, making it the perfect toolset for those who want to take their trading to the next level.

In Builder, you can automate your workflow; alternatively, you can create a custom workflow with as many steps as you like using Custom projects. You can chain together several builds, retests, optimizations, and other operations before letting it run in completely automatic mode.

StrategyQuant uses strategy templates to build strategies; these templates contain special placeholder blocks (referred to as Random placeholders) in specific locations and then generate blocks randomly to fill those locations.

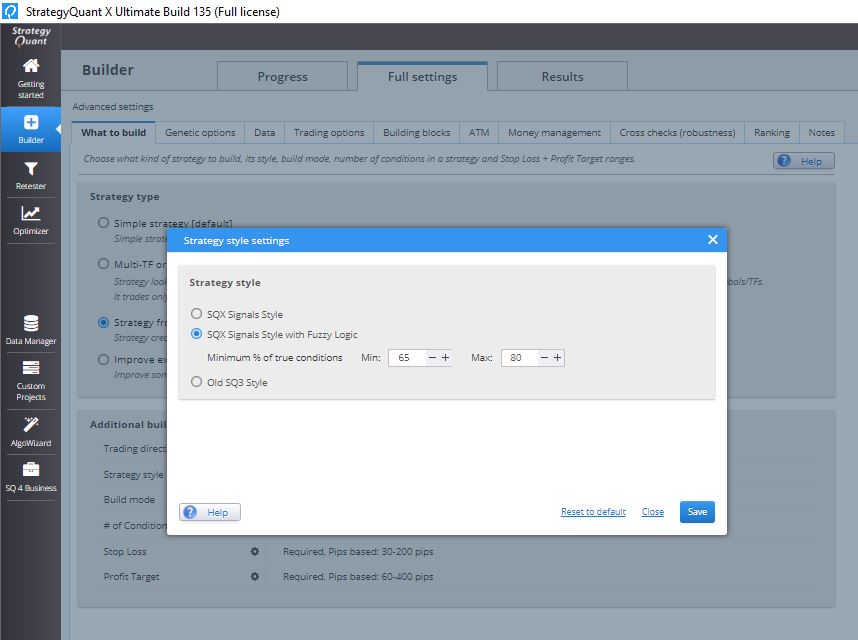

You can design strategies using fuzzy logic by specifying the percentage of requirements that must be true for a signal to be legitimate. This allows you to develop strategies where the logic is “fuzzy” rather than accurate. This function offers a new class of tactics.