What is Quant-Bot?

QuantBot is a leading fintech firm with over 15 years of experience in developing cutting-edge software solutions for the financial markets. We specialize in creating automated trading systems powered by advanced quantitative models and statistical methodologies. Our expertise spans software engineering, quantitative research, machine learning, and comprehensive market analysis, enabling us to design robust, high-performance tools tailored to the complexities of modern finance.

Team

Entrepreneurs, financial experts, statisticians, and developers.

Challenges

Make it possible for every member to be profitable.

Solutions

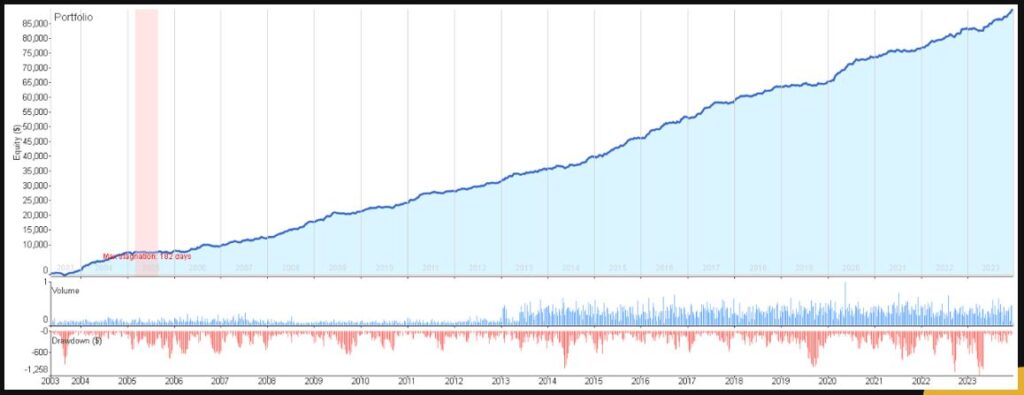

Our strategies aim for consistent returns and strong risk-adjusted performance, with minimal drawdowns to protect capital.

Workflow Methodology

Transparency and credibility are critical to our success.

Our comprehensive methodology process roadmap ensures that your strategy is robust and undergoes proper testing and optimization. We also provide fully Customizable automatic workflows so you can optimize your performance and stay on top of your objectives.

Formulation of concept (Trend, reversal, fuzzy, etc), specifying instrument type, timeframe, stop-loss and take profit, etc.

In sample – out of sample, Monte Carlo tests (slippage, spread, resampling, exact, historical, parameters, etc.)

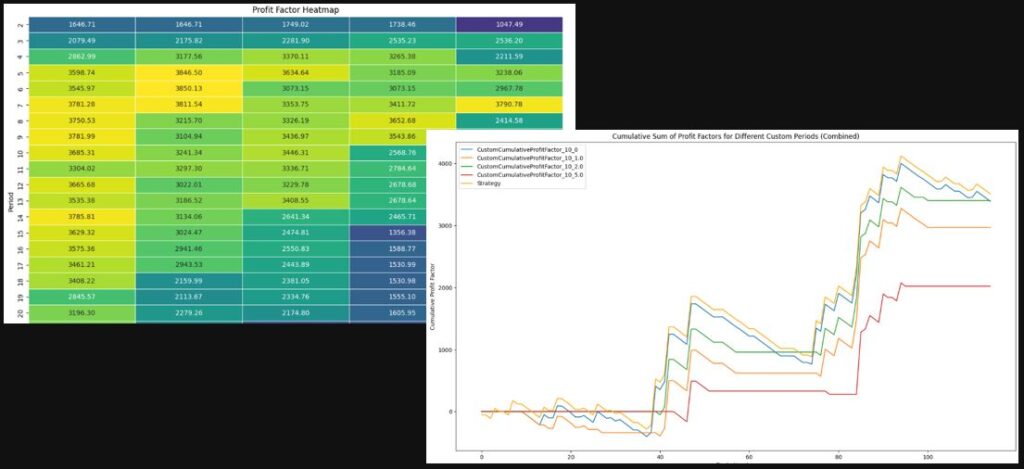

Walk-forward optimization, walk-forward matrix, check overfitting, final out of sample test.

Trading strategies with small lot size, monitoring and comparing results to robustness testing phase.

Trading strategies, monitoring 24/7 drawdown percentage.

Periodic optimization, replacing non-performing strategies, enhancing portfolios.

Formulation of concept (Trend, reversal, fuzzy, etc), specifying instrument type, timeframe, stop-loss and take profit, etc.

In sample – out of sample, Monte Carlo tests (slippage, spread, resampling, exact, historical, parameters, etc.)

Walk-forward optimization, walk-forward matrix, check overfitting, final out of sample test.

Trading strategies with small lot size, monitoring and comparing results to robustness testing phase.

Trading strategies, monitoring 24/7 drawdown percentage.

Periodic optimization, replacing non-performing strategies, enhancing portfolios.

Different Filtration

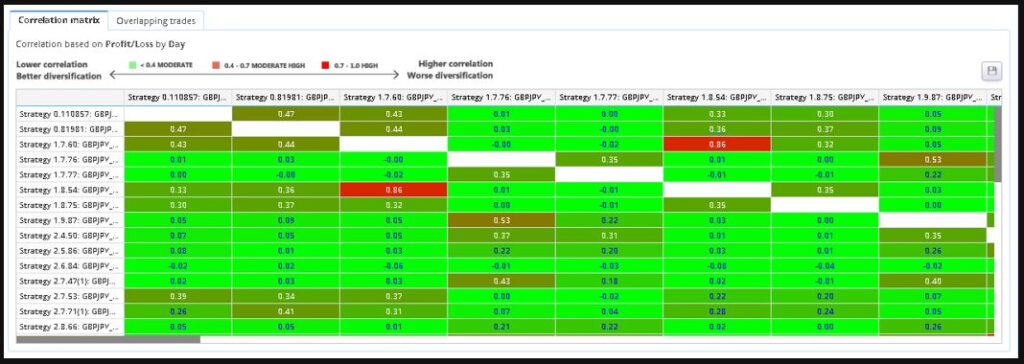

Correlation Filtration

Portfolio Building

Building an investment portfolio by setting goals and time horizons, understanding risk tolerance, matching the account type with the goals, selecting instruments, creating asset allocation and diversification, reducing correlation, and finally monitoring, rebalancing, and adjusting.

Triple-Layered Risk Protection

Our risk management framework is built on three layers of protection to ensure capital preservation and controlled volatility. First, each individual trading bot has its own built-in risk controls, including stop-loss mechanisms for every order. Second, an overarching equity control bot monitors overall portfolio performance, enforcing strict daily, monthly, and total loss limits to prevent excessive drawdowns. Finally, our strategies are continuously supervised through manual monitoring, adding an extra layer of oversight to maintain stability and optimize risk-adjusted returns compared to traditional funds.

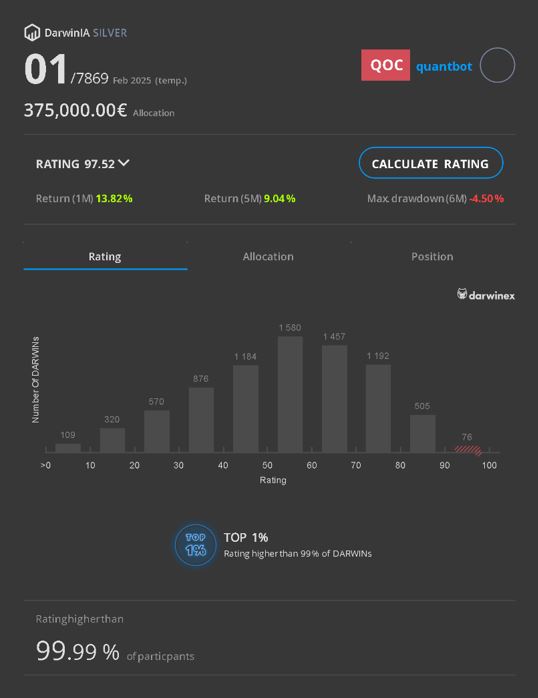

Invest with Confidence

Harness the power of our sophisticated, risk-managed trading strategies to achieve consistent, risk-adjusted returns. With our triple-layered risk protection and proven performance, your capital is safeguarded while maximizing growth potential. Join us today and invest with confidence in a smarter, more resilient approach to trading.